I enjoy keeping my finger on the pulse, checking out what new games get released, what new mechanisms or themes get introduced to the hobby. As someone who writes about games, it’s gratifying to do deep dives into games that just came out and help them find their right audience. It’s a similar story on the other side of the equation: people reading about games are also much more interested in newer games than older ones. Game development and production quality has made great leaps over the years, and a lot of previous titles are now considered boring or even barely playable.

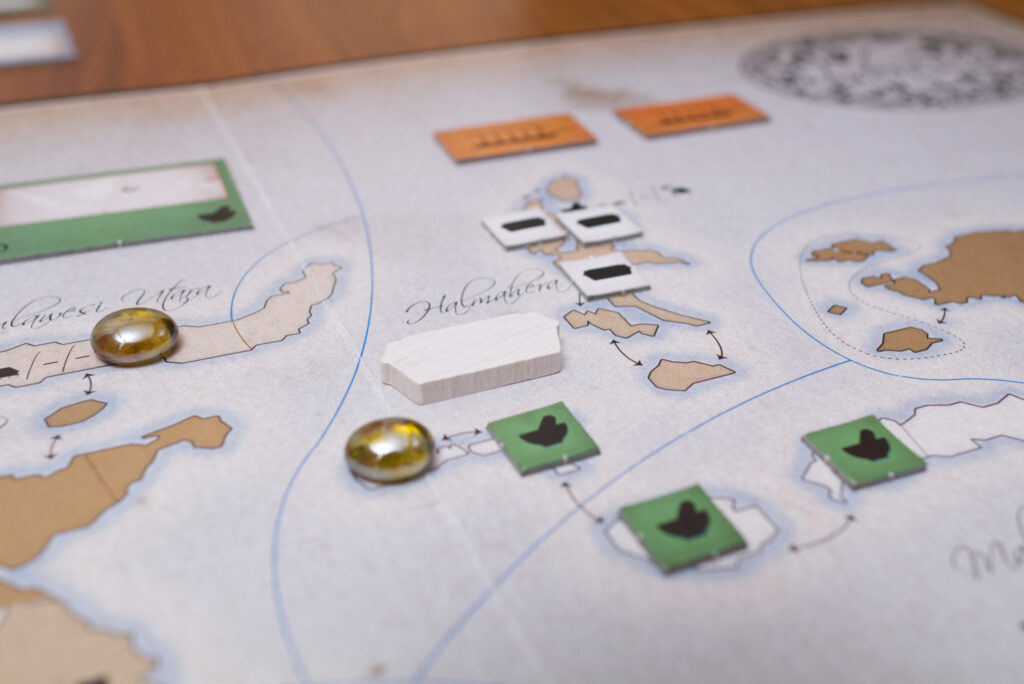

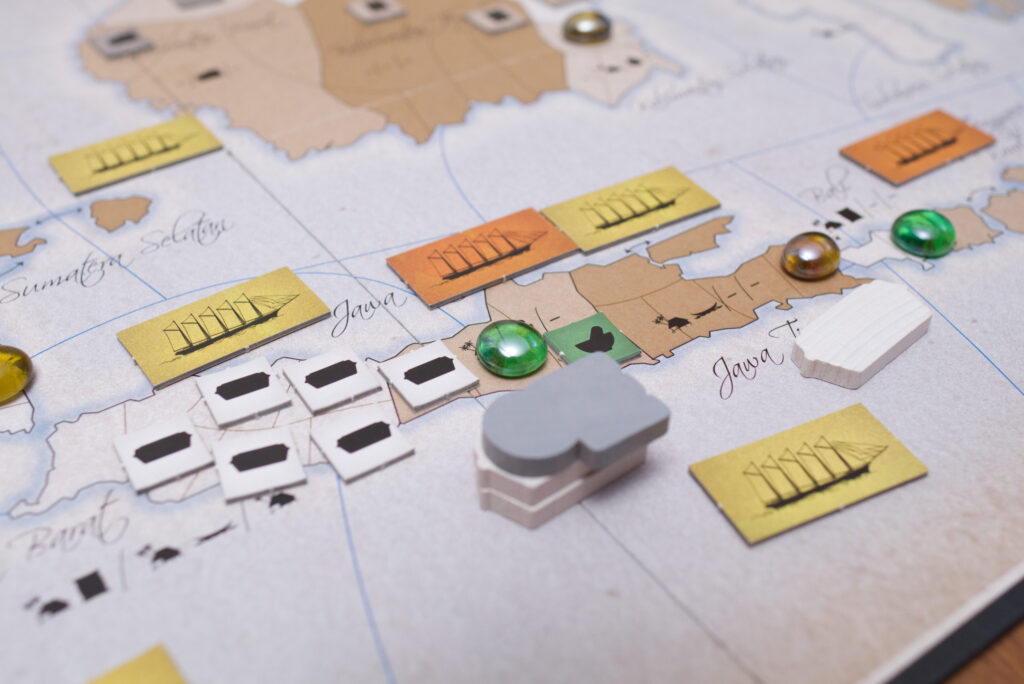

Contrary to that, the game I’m most fascinated with right now turns out to be one from 2005! One with a brownish-grey map that looks nothing like modern board games, comes with strangely large wooden tokens, some glass beads, paper money, and a few pieces of cardboard. On the table, this is the game where I’ve struggled the most to produce a good photo of and the box isn’t much help either. The backside doesn’t even show the game for crying out loud, but is simply a plain white emptiness, no text, no illustrations. How can this almost 20 year old game keep me captivated where lots of new release can’t?

Setup

Indonesia comes to us from Dutch board game publisher / design duo Splotter Spellen, known for their innovative and often quirky designs such as Roads & Boats, Food Chain Magnate, or Horseless Carriage. Out of the Splotter games I’ve played so far, this one has the simplest components and as a result setup is quite quick: unfold the main board, shuffle the few city cards and deal each player one for each of the three eras (A, B, C) of the game. Give every player a set of personal ship tokens, a little bit of starting money, some wooden discs they place on the board’s R&D tracks and one for turn order, and that’s it. You’re ready to go.

So let’s digest what we are seeing here. In Indonesia, players acquire and invest in companies all around Indonesia. Each potential company is marked on the board with a big cardboard deed token that shows the type of company and its starting region. The main distinction is between shipping companies that help deliver goods and production companies that produce them.

The map itself looks quite unusual. Land regions are coloured in different shades of brown and beige, subdivided into smaller building locations. The latter are sometimes tiny, sometimes large, both of which doesn’t really matter because they each can hold exactly one cardboard production token. What matters more is how they are topologically connected as that prescribes how a company might be able to expand in the future. Note that some gaps of water cannot be crossed while others are marked with arrows to indicate that two locations are considered adjacent. There are even groups of tiny islands circled by a dotted line that are considered as a single location. Overall, it’s an unusual look and fans have created various alternative designs that represent this exact same map but with a different, easier to read layout, for example as hex fields.

The waterways are also split into sea regions that have odd shapes and in a few cases, a tiny separating line might make all the difference. Finally there are markings on the board that at first might look strange and alien. They are a shorthand for what type of company or new city will potentially be created in that region and in which of the eras. The thing to note here is that this is all pre-determined, unlike typical modern designs that would add elements of setup randomness here.

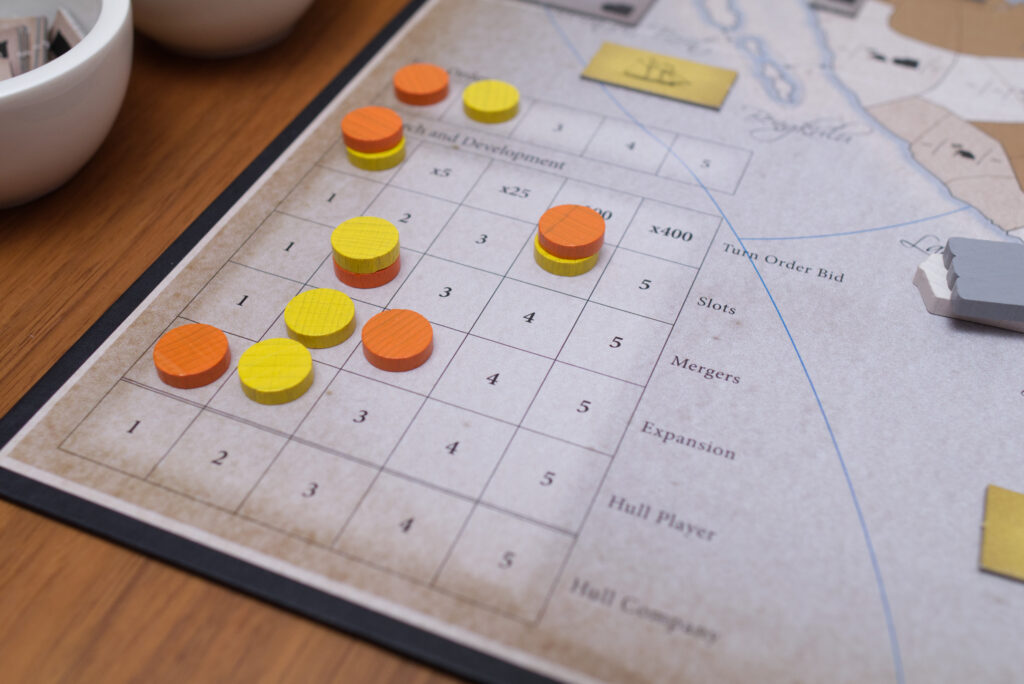

In the bottom left corner of the board are the all important turn order track and the R&D tracks. For now, it suffices to say that bidding for turn order is fierce, and R&D surprisingly doesn’t even cost anything. But we’re getting ahead of ourself.

New Era, New Cities

A round in Indonesia is split into multiple phases, some requiring a single, quick action from each player while others can get more involved. At the top of the round, players check if the game goes into a new era. There are three in total simply called A, B, and C. Era A starts off with rice and spice companies and focuses mainly on the central area of the map, B introduces the more valuable rubber and puts an emphasis on the western area, and C introduces oil, the most valuable good, and opens up the eastern part of the map.

If at the end of any round all company deeds have been acquired or only deeds of a single type remain on the board, a new era is introduced. This is also what happens at the very start of the game: the company deeds of the era A are placed on the board and then each player plays their city card to place the first couple of cities on the board.

Each city card shows three regions where the city can be created. There are only few rules: no region can have two cities, a city must be placed in a building location adjacent to the sea, and no city can be placed in a location that already contains a cardboard token. That’s it! The dynamic that springs from this is quite extraordinary: will the cities be easily accessible from multiple sea regions or not? Are they all clumped together or spread out? Will there be any at all in the east? This might sound rather boring to you since I haven’t even talked about selling goods yet. Simplified, a production company can only sell their goods if they have a connection from their production sites via shipping companies in adjacent sea regions all the way to cities. Each city has limited demand – to start with only a single good of each type per round – that is fought over among the players.

To illustrate, let me talk you through a typical situation on your very first turn of the game. The new cities have been placed, turn order has been bid on, and it now comes down to you selecting your first company. Acquiring a company doesn’t even cost money, so that concern is out of the window, it’s all about location and potential income. At the start of the game, your R&D for “slots” is at 1, translating to you only being able to hold the deed for a single company. So you pick up a rice company as it’s close to multiple cities. Good choice, right? Shame that no other player after you decides to pick up one of the shipping companies in that region and so you won’t be able to ship off any goods this turn at all. Or they picked one up but didn’t establish a route immediately and instead head towards a city that’s much farther away, increasing the transport costs you’ll have to pay and therefore their portion of your profits. So you’re screwed already, great. Next time you plan to start by acquiring a shipping company. But will you? There are downsides to this as well, such that there might be competition for transporting things and if you’re not careful, you might be helping other players more than you help yourself.

This just to give you a taste for how important the distribution and exact locations of those starting cities are. It’s definitely advised to check all three era cards one receives and do some longterm planning before the game even begins.

Operations

So let’s jump out of order to the operations phase towards the end of the round structure. It’s the beating heart of Indonesia where money is made and which motivates the decisions in all the other phases. During operations, the active player choses one of their company deeds, flips it over, and processes the company for that round. This goes round and round until all companies have been operated.

For a shipping company, operation is easy as the company just gets to expand. Each deed shows an era limit of how many ships that company can control in each era and if that limit isn’t maxed out, the player can add additional ships in adjacent regions up to the level of expansion they have researched on the R&D track. Expansion starts at level 1, so a shipping company owner can by default add one new ship per round (up to the era limit of the company). That’s it, no cost, no money earned.

Production companies on the other hand are slightly more complicated. For each token on the board, they have to sell one unit of product (e.g. a size-5 rice company produces 5 rice each turn). Starting from any of the tokens representing the company, each good is moved over a connection of ships belonging to a single shipping company (so no hand offs between different shipping lines) to a city. By default, a ship can only transport a single good per company operation but this can be increased with the “Hull” R&D. A city as previously mentioned only has a fixed amount of goods per type it will buy each round that is equal to its size (yellow = 1, green = 2, red = 3). For each good that travels, the player has to pay 5 Rupee per ship (=per sea region) on its way to a city. So for the basic product of rice which sells for 20 Rupee, delivery to a city two ships away already cuts your profit in half. Anything further helps the owner of the shipping company more than you, which hurts as each player has to sell all the goods they can, even if they might come at a loss! As a consequence, owners of production companies are incentivised to place new cities close to their companies while owners of shipping companies want to build as artificially long connections as possible.

There are some fun decision points embedded in this mechanism. In some situations, it might even be opportune to ship to a more distant city, simply to block an opponent from making a sale and forcing them to use a longer route via your ships. Or influence which cities grow because at the end of the round all cities that received all currently produced types of goods to their full demand will increase in size.

If a player manages to sell the whole production of their company, the company expands for free a number of tokens equal to their R&D “Expansion” level. Otherwise the player may still expand but has to pay for each step money equal to the price of the good (e.g. 20 Rupee for a rice company). Paying for expansion hurts a lot. However, it can make sense if by expanding the company reaches a new sea region (cutting down the length of connection to cities) or boost production for subsequent rounds (and thus potentially satisfying city demand before other players have a chance to sell). In some situations, it can even make sense to expand just to increase the price of the company and make mergers harder.

R&D

One of the most surprising elements of Indonesia is that for many things players do not have to pay money. Acquiring new companies is free, it just requires an empty slot to hold another deed. In a similar fashion, R&D doesn’t cost anything, every player just gets one advancement on any track of their choosing. There are 6 options: turn order bid gives a player a multiplier on the money they actually spend (e.g. 25x turns a 4 Rupee spend into a 100 Rupee bid), slots for being able to hold more company deeds, mergers (which we’ll talk about in a moment), expansion to boost how quick each company can grow, and hull to increase the number of goods that can be transported per ship. You might have noticed that these are 5 R&D tracks but I said 6 options. In what reminded me a bit of the R&D mechanism in Horseless Carriage, players are allowed to push other players’ hull capacity! This might sound crazy at first, but is actually rather normal. Consider the following situation:

You’re the owner of a well established shipping company, there are large production companies and a good number of cities connected to your ships. Do you increase your hull? Intuitively, most players will go for it as that means more goods are shipped and thus more transport fees are payed. However, if the connection between producer and city is short, they might make 20 Rupee per sale where you only make 5. Increasing your hull might actually hurt you more than it helps. On the other hand, let’s say the producer’s goods have to travel long distances, increasing your hull forces them to sell more and might make you more money than them.

So while new players intuitively try to invest in their shipping companies by increasing hull, it becomes a game of chicken after only a few plays. The opportunity cost of spending the single, valuable R&D advancement on hull instead of one of the other tracks is high, so you’ll typically try to avoid it if you can. Choosing for example “slot” instead of “hull” might result in you acquiring a completely new company next round, which might be much more profitable than the few Rupees you get for your ships. It all depends …

Mergers

The pièce de résistance of Indonesia is its merger mechanism. This is the single thing why you will want to play this game or run away shrieking in horror. After turn order bid but before acquisition of new companies, players can propose mergers. A merger happens between two companies of the same type (with an exception for creating siap faji, a combination of rice and spice) owned by any player, the proposing player just needs to have their merger R&D up to the number of involved company deeds and be able to pay the minimum bid. To calculate it, take the number of tokens both companies have on the board times the price of the produced good. Players keep increasing bids until all but one have passed and that player pays out the two previous owners proportional to the size of their companies.

A merger can serve a surprising number of different purposes: merging two self-owned companies frees up a slot for further acquisitions, merging two shipping companies combines them to a single contiguous line, merging two opponent companies is the quickest way to rip future income out of their hands, merging your own company and losing might be a good way to make quick cash, …

Indonesia’s merger mechanism is surprisingly simple, so simple I wouldn’t really need to go into much more detail here to explain it. However, deciding if one should propose a certain merger, which merger first, and of course what to bid is headache inducing. Sometimes it’s all about timing it so no other player can even make a bid, sometimes it’s about artificially increasing the bid so an opponent has insufficient funds left when next turn’s merger phase comes around.

It’s hard to express the excitement of mergers but it’s best described as inducing a constant fear that nothing is safe and you might have overbid. Evaluating the right price to pay for a merger is tricky because it not only depends on the size of the company but on how much income it will generate and for how long. Will you be able to hold it for one round or two? Will someone else come first in turn order and you won’t even be able to sell everything the company can produce? Is a company safe from further mergers because nobody has a high enough merger R&D to involve it in another merger? How many rounds will the game still last? …

Game End

The game ends when in era C no company deed is still available or only those of a single company type. The player with the most money wins, simple as that. What is unusual is that the companies one owns at this point do not get somehow converted into money. Instead, all income made in the last round is doubled which has a similar effect: it definitely makes sense to own companies in the last round instead of trying to dump them on other players during a late merger. On the other hand, if you get them to overpay, it might be a good deal …

Player Count, Play Length, and Solo Mode

Playing time of Indonesia is substantial, I would block 3-4 hours. Somewhat unexpectedly, playing time noticeably decreases with increasing player count which might be why most seem to recommend it for 4 or 5 players. I’ve played it with 3 and found it highly enjoyable but things ground to a halt towards the end of era B playing with only two players. The issue seems to be that while the game doubles the number of new cities that come out each era, the game’s internal timing mechanism is still based on available company deeds. Existing companies have more time to increase to substantial sizes making picking up a new one less attractive than other options when it comes to R&D. I think it’s a shame because we had lots of fun playing 2p and playing with hidden money still made the mergers exciting. The most logical fix that I could think of would be to add some mechanism how company deeds deprecate and get removed from the board if not acquired, e.g. each round the highest value deed is removed. But I haven’t seen any official variant for this. As it stands, I don’t think I will play Indonesia 2p again.

There is also no official solo mode which is why I once again tried to craft my own: Indonesia Solo Mode: Local Competition. It’s still in development and needs further tweaking but produces a nice playing experience already. The automa is also designed to be used for higher player counts, which might serve as a potential fix for the 2p issue I described above by adding one or two automa to the party. I haven’t yet been able to test this much though.

Editions, Production Issues, and Upgrades

There exist two editions of Indonesia with pre-orders for a new third edition being announced to open up in 2024 (but no release date is announced as far as I know). At this point, there is little to no information on what exactly will be changed for the third edition and how substantial those changes might be. However, for those that are unfamiliar with Splotter games, be aware that there are often multiple years between reprints. If you’re interested in getting a copy, either join the pre-orders or spend some time to find a good condition second hand copy at a reasonable price. I was lucky for Indonesia, but I still have yet to find a copy of Antiquity that isn’t damaged or costs an arm and a leg!

My copy is from the 2016 Second Edition which had an unfortunate production issue. The wooden resource tokens that were supposed to be used on the map to represent the companies turned out way too large (some say 4 times too large). Splotter being a small operation run by enthusiasts, not a huge money making machine, couldn’t justify the costs of producing and sending out replacements, but luckily the cardboard tokens that were originally intended as delivery markers can be used in their place. This is why in the images in these first impressions you’ll see cardboard chits on the map with occasionally large resource tokens next to cities upon delivery. This also explains why the cardboard tokens have a “2” on the reverse: it was intended to simplify the delivery step but now no longer has any purpose.

As far as I know, the other differences between editions are that the sea regions around Bali have been clarified and that the Second Edition replaced wooden ship tokens with cardboard tokens. This might sound like a downgrade, but as far as I understood it, the wooden tokens were produced in player colours but actually didn’t belong to players. So it could be that the orange player would use blue and yellow boats because they owned two separate lines. That also explains the “Hull player” and “Hull company” R&D tracks. The later was only functional in the first edition to easily mark which shipping line had what hull size as the color didn’t necessarily translate to the correct player.

Long story short, I’m happy with my copy of the Second Edition and as a friend commented: when you’re playing it, it actually looks nice. Of course it would have been great if the wooden resource tokens would have been the correct size, but the version is fully playable. The only “issue” I found is that when multiple players have ships in the same sea region, the large cardboard tokens can get crowded and overlap. While some prefer the first edition, it seems like the majority recommends the second edition with its updated map. I just wish there was something to put on the board to clearly mark which company belongs to which player.

There are also lots of options for upgrading Indonesia. As I mentioned in the beginning, there exist a number of alternate designs for the map that can be found on BGG and people do poster-size prints of them. The two most popular upgrades I found were either getting the (quite expansive but lovely looking) ships and resources from MeepleSource

or the much cheaper standard cubes and Catan style ships from Spielmaterial.de. I haven’t spent any money on upgrades yet, especially as long as it’s not clear what changes Third Edition might bring. But I do have to say those MeepleSource ships do look tempting. Good thing they are out of stock right now …

Conclusion

Indonesia is a fascinating game. It’s definitely on the heavier side with regard to play length and the complexity of decisions to be made. But the rules themselves are rather short and quite straight forward. It’s an achievement how many implications and memorable moments evolve out of these rules. Take turn order bid: Do I need to deliver first or be last so that owner of the shipping company can expand first? How much money do I spend on the bid and will that bite me when the next round of mergers comes around? Or take expanding a company: it can happen that due to an expansion, the last spot for a still available company deed gets occupied, the deed goes out of game, and that triggers the end of an era before other players expected it. There are many interwoven things happening here, and the great thing is they don’t need many rules. It’s complexity originating from a system, not complexity by adding exceptions and special rules.

What I also appreciate is that Indonesia gives a sense of “I built this up” much stronger than with many modern Euros. At the same time, Indonesia keeps players on their toes. Nothing is safe, whatever you do might or might not be yours a few rounds down the line. Or from another perspective, something you desire might become yours if you have the right funds at the right time. This makes Indonesia a rather hard game to read. It might look like one player is ahead because they have better production capabilities, but that might have come at the cost of spending a lot of money and R&D actions on it. Speaking of which, the rules instruct the players to choose between open and hidden money. Despite me hating hidden trackable information, I recommend playing with hidden money. That little bit of uncertainty during mergers just is a lot of fun.

Overall, I find Indonesia in line with other Splotter games: it’s expensive and the artwork/production isn’t really on the level that many people expect nowadays. However, there is more gameplay and substance in this single game than in multiple big Kickstarter projects combined. The way the merger mechanism mixes up everything is brilliant, choosing how to spend your one R&D advancement per turn is agonising, turn order bid crucial. Indonesia really feels like a game you could get out every couple of months and many years down the line, it’d still be in your collection because there remain new stories to be told. You need at least two other players that are willing to play a 3+ hour economic game that can be quite punishing, but that’s probably the biggest caveat of Indonesia. And I know Splotter isn’t big on solo modes, but I wish at least the 2p mode would have been better adapted. Maybe an easy improvement to add to the upcoming Third Edition.

As with every Splotter game, there are things to critique and which could be improved. But man, when it comes to game design, Jeroen and Joris are definitely in a class of their own. I can only imagine the years and years of designing, playtesting, and balancing that must have gone into this game. And so it’s fitting to call this only first impressions instead of a review: there is still so much to explore. If you have the chance to play Indonesia and don’t mind the length of play, definitely give it a try. It might not look great in photos, but there is a lot of game in there. One of the best purchases I made in a while!

I read this review as part of my due diligence prior to buying the game. Since this review was written Splotter have opened up pre-orders for a new edition. I’ve ordered this.

Thank you, Alex.