You have to hand it to Dutch independent publisher / design duo Splotter Spellen: if you’re in the market for innovative game design mixed with high amounts of player interaction and quirky humour, they are hard to beat. I’ve been slowly digging my way through their back catalogue, from 2005’s Indonesia to 2004’s Antiquity (which are both now amongst my favourites), from 2012’s The Great Zimbabwe to 1999’s Bus and Roads & Boats. A few took a while to find, but the game that has eluded me the most was Greed Incorporated.

You see, for most of the big Splotter games, one can readily find a playthrough by Heavy Cardboard or some other high quality coverage that gives one a good sense of what the game is like to play. Greed Incorporated however is one of those games that almost feels lost to time, never as popular as its siblings and too rare to pick up on a whim. I mean who pays upwards of 200€ for a game that one knows little about and likely has no chance to try-before-buy? Luckily, I by chance found someone willing to part with their copy for a very fair price and can thus spread the news: this game isn’t perfect, but it sure as heck is wickedly fun!

Setup

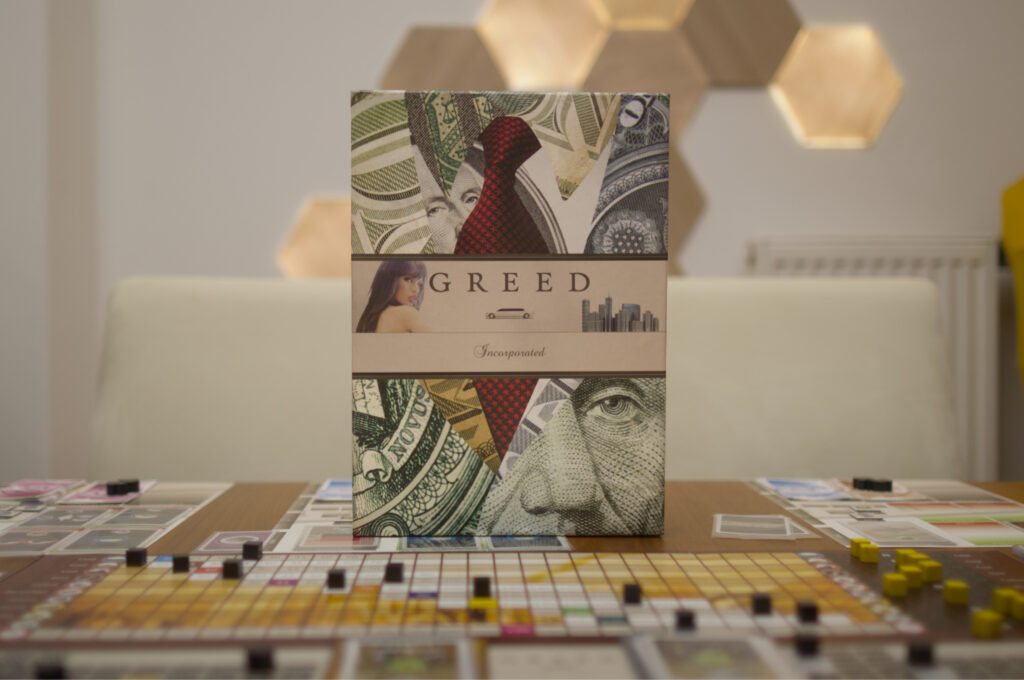

Greed Incorporated comes in one of the standard-size Splotter boxes, similar to Food Chain Magnate, later editions of Antiquity, or Indonesian, including the traditionally completely white back side of the box. It’s still funny to me that Splotter for the longest time never bothered with a print on the back side of their games. Where other games might show off their components or let potential buyers know what the game is about, there is nothing but a white void. It’s a little bit like a cheeky “if you don’t already know you’re getting into, you probably shouldn’t buy this”.

Inside, we find a main board showing price and trend tracks for various goods, from sand to railroads and textiles to “blah blah” (represented as a presentation board). Anyone who has ever had to endure corporate trainings done by some over-payed consultant or attend large scale meetings will surely relate to that last one.

The goods themselves are available as cards instead of the typical wooden or cardboard tokens you might expect from other games. There are assets that can be acquired, status item cards for players to splurge their hard earned cash on, a few oversized wooden tokens, and a whole bunch of sheets to represent companies that can be founded. All and all, the content can best be described as rather barren or minimal. As much as I may try, this game is really hard to make look good in photos!

Setup itself is rather simple: unfold the board, place a couple of cubes to mark current prices, ready the decks of status symbols and assets, and give each player the elements of their first company: an A4 company sheet, one of their marker tokens in the CEO position of the company’s org chart, 100 bucks in it’s free cash reserve, and a company starting card that’s mostly relevant for assigning a random initial order and mix up the starting prices on the market a bit. Give each player two asset cards onto their hand, and the mayhem may begin …

The Makings of a Company: Assets & Org-Charts

A round of Greed is structured in 10 phases, but some of them are so trivial that in reality it feels more like just 3-4. Things kick off by each player choosing one of the two asset cards on their hand and placing it face down in the centre of the table, marking it with one of their player tokens on top of it. Each player draws back up to two cards before all played cards are revealed, and that’s already the first phase done.

Each asset has a few properties. First is the fact that simply by adding an asset to the market, it will influence the price trend of some other good, which is the first aspect to consider when choosing which of the two cards to play. Do you want to raise the price of something one of your companies can produce or rather trash the price of something your competitors produce?

The next important aspect are the goods an asset can produce and whether it is a primary producer (no inputs needed) or if it will need other goods to get activated. For example, an asset might turn single a coal and a cotton into the more valuable “textiles” good. In a very reduced way, there is a tech tree hidden here, with for example land leading to houses leading to loans. Over time, the cards drawn from the asset deck get more and more powerful and that nice engine one might have assembled during the early parts of the game will hardly bring in any money later in the game.

There are two aspects that are quite unusual for an engine building game: for one, each asset can only be used once per turn, often to only produce a single resource. Two, each company has slots for only four assets. We’ll see in a moment why this will become highly relevant. Once the new assets have been revealed, those and any that may remain from previous rounds are auctioned off by a single blind bid. Whichever company bids the highest gets to be first to pick up a single asset, with every other company following in descending order of their bids.

Part of the package is the marker of the player who pitched in the asset. If a company buys an asset, the player token on top of it is added to the org chart and might become CFO, COO, or one of the other hopeful managers without a special title. For most intents and purposes, it is only relevant who is CEO because that person acts for that company. But being next in line of course has its own benefits.

Player vs Company

Before continuing, it is important to note that Greed is one of those games that clearly separates the belongings of a company from the belongings of a player, in some ways similar to 18xx games. Initially, all players start without any money to their own name and 100 bucks in the “free cash” box of the company they control. This is the money the CEO can spent to for example invest in acquiring new assets for the company. In contrast, any earnings the company will create in a round are placed in the separate “new income” box. It cannot be touched at all until time progresses and it eventually moves over to the “free cash” box.

The reason for this is a precarious rule: if at the end of the round a company’s new earnings aren’t higher than its last round earnings, someone needs to get fired! The way this is implemented is actually quite funny: going down the org chart, first the CEO, than the COO, and finally the CFO have to point a finger at any of the other two or themselves. Anyone who is pointed at by at least one person gets fired. But wait! Why should one point to oneself? Well, one word: bonuses! If a CEO gets fired, they get 40% of the cash the company currently has in its free cash box as a nice exit bonus. For any COO or CFO, it’s 20%. And here comes the kicker: this is the only way in the whole game how a player can earn personal money. And players need personal cash to buy frivolous status symbols like a yacht, because those represent the only source of VP in the whole game!

After firing is done, the remaining markers rise up the ladder, often giving a new player control over the company. But they face the same issue as their predecessor, just a round later: whatever money is in the last year’s earnings box needs to be beaten. Note that when all three C-level positions got fired, that means the company will only have 20% of its free cash left to actually invest next year, which makes things even more tricky.

Production and Selling

So let’s back up a little. How does a company make money to eventually pay those bonuses? During the production phase, any primary producer will generate the goods printed on its card (e.g. a single card of coal). Any secondary producer can be used once per round to turn its input goods into its output goods, and all of those can then be sold at current market value or stored (for a small fee) for a later round. The current market value of a resource evolves based on the price trend tracks, and those get influenced by whatever asset cards players pitched in at the top of the round.

Greed could be a boring engine-building game if it wouldn’t have been set up in a way that it is rare for a single company to be able to produce high-value goods all on its own. This is in part to the blind bidding when acquiring assets and in part due to the quite constricting asset limit per company of four. It is much more likely that a company will have to trade goods or usage of their assets to other companies, of course for a price. So it’s a negotiation game, you’ll say, what’s so special about that? Well, it’s a negotiation game where you fight to survive. As mentioned, if a company doesn’t keep increasing its earnings year-over-year, someone’s head will roll and it might be yours. So trading can get quite creative.

A simple example: let’s say after selling resources, one of your companies is short of beating last year’s earnings by just a few bucks. It might offer another company to trade the same resource back and forth for the same price, just because money will thus move from the “free cash” box (the money payed for a resource) to the “new earnings” box (the money received by the other company). Or a company might deal with its assets’ capabilities to transform goods, take goods now and pay later, or pay ridiculous amounts of money for a cheap resource in order to dump its money reserve to another company (often controlled by the same player), and so on. The rulebook offers quite the variety of examples on how to do creative trading to get new players into the right line of thinking. We found this super useful because it often breaks conventions learned from many other economic games.

Regardless of what gets produced and what deals get made, the production/trading/sell part of the round ends by all companies shifting their last year’s earnings into the free cash box and this years earnings into the “last year’s earnings” box. Quite handy, the game comes with a whole bunch of chunky wooden tokens in the shape of a dollar sign that can be placed on top of last year’s earnings to prevent players accidentally using money from the wrong box.

In The End, It’s All About The Bling

The final piece of the puzzle is the purchasing of status symbols. These are cards worth an increasing amount of VP, with only two being auctioned off each round. The minimum bit starts off rather reasonably but one round’s winning bid will dictate next round’s minimal bid. Or in other words: prices only go up, and that they do fast!

Having this very limited capability to actually convert money into VP (only two players will be able to do so per round) adds a whole bunch of interesting wrinkles to an already quite crazy sort-of-engine building, market manipulation, negotiation game. The only way to get VP is by getting the winning bid for a status symbol. The only way to earn money to win the bid is by getting fired. But in order for that to be worth it, a company must first have earned at least some reasonable amount of cash, which takes time. And if the lovely co-players also hold a C-level position, they’ll get bonuses at the same time as you and suddenly being flush with cash won’t be worth much because others will be too!

But even if one builds up a nice cash-generating engine and one’s company keeps collecting more and more money, it might be too late when it goes bust. By that time, prices for status symbols usually have already inflated beyond believe. A friend of mine managed to create the perfect example of this in our last session: Their company went bust early, with them getting 60% and me 20% of the rather young company’s cash. I decided to invest my money into a second company while they for multiple rounds kept paying the minimum bid of 50 and without any possible contestation (since no one else’s company had gone bust) collected a whole lot of early VP for peanuts.

My own companies did well, but by the time it was opportune to get fired, someone else’s company also went bust and suddenly it was two players with a lot of cash at hand. Prices skyrocketed so much that a single status symbol would cost upwards of 800 bucks! For just 3×50 bucks, my friend had managed to get twice as many VP as I could buy with 6x the cash.

Game End

The game ends once the deck of asset cards is depleted and all players have pitched in the last card from their hand as well. This unfortunately makes for a somewhat unsatisfactory final act of the game. It keeps making less and less sense to form a new company or even buy assets for an existing one, and in the last round nobody cares about earnings because they won’t be shifted into the free cash box in time for one last round of firing/bonuses. The result is that after hours of excited haggling, the game seems to fizzle out a bit on the home stretch.

I’ve so far only been able to play Greed Incorporated with 3 players (the minimum amount of players, with 5 being the possible maximum) and our plays have lasted a chunky 3.5-4h. While the rules are rather short and most of the phases trivially quick to process, having a tight economy where everything affects everything and a negotiation element on top of it of course leads to longer discussions. But except for those last 1-2 rounds, time usually just flew by with us laughing our asses off.

Conclusion

And that already sums it up quite well. This game is way more fun than I had anticipated it to be! Granted, it looks a bit dreary with no eye catching art or components that would make players go “ooh, I want to play this” … actually the contrary is more likely. But the interlinking of the various elements is quite clever, especially for this distilled state. Greed Incorporated is another one of those Splotter games where you wonder how so little rules can create so many interesting dilemma and emergent gameplay. Take for example the rather trivial seeming decision of which of your two asset cards to pitch in. I had a play where there was a noticeable shortage in one resource because one player had decided to keep one of the few primary producers that could generate that resource on their hand for the whole game. That pretty much took a whole branch of industries out of the running, or at least make it way more unattractive. You don’t want to put things in the market that help others. At the same time, you want other players to pick your asset, because that’s the only way to get positions in their companies and ultimately become CEO, or at least get a nice bonus.

Then there is the timing consideration of when best to run a company into the ground and the aspect of whether you should pick the asset that’s best for your company or rather pick one you put on the market yourself, just to get another seat at the table before the company goes bust. There is the negotiation aspect, the question of selling vs storing goods, influencing market prices, assets almost becoming obsolete, status symbols only getting more and more expansive, 18xx-style dumping of companies, … and all of it from a rather compact ruleset.

The best part of Greed Incorporated is simply how bonkers it is. The deals you’ll make will get more and more creative—or rather far fetched—, the finger pointing when someone needs to get fired is just funny, the quirky humour of what the status symbols represent fits nicely (although some of them have aged badly). It’s a game with quite the substantial play time and consequences of actions that are hard to predict. But no matter if my companies did well or not, irrespective of whether I managed to earn VP or not, I sure was always laughing while playing. Greed Incorporated somehow manages to capture this feeling of “this is simply absurd” as you continue to wheel and deal like there is no tomorrow.

On the negative side, there is of course the substantial price. I payed 130€ for an unplayed copy, and that was an exceptionally low price. There are indications that a new, updated edition might be coming at some point down the line which should help with prices, but with Splotter reprints it often can take years for them to become a reality. For the current second-hand price of a Greed Incorporated, one can get multiple excellent games, and even staying within Splotter’s own oeuvre, I personally would rather buy a copy of Antiquity, Indonesia, Bus, or my personal favourite Horseless Carriage.

Then there is the somewhat odd feeling end, but since it’s only the last two or so rounds, I’m okay with that part. The economy and engine building will feel strange to a lot of players because this game is not about building the best running company. You don’t care about companies, they are only a means to an end, a temporary stepping stone. There is some randomness in the asset cards and it can sometimes feel like you keep drawing the crappy stuff nobody wants. And finally there is the 3+ hours of playtime that will be too much for a lot of players, especially if you can see that there’s no chance for you to catch up halfway through the game.

In the end though, I’m really happy to now own a copy and I can’t see Greed Incorporated leaving my collection any time soon. It’s ridiculous, it’s fun, it’s different. At the current price point, I can’t really recommend anybody picking up a copy except hardcore Splotter fans, but I would strongly recommend giving it a play if you ever get the chance. It is a lovely satire of 90s Wall Street capitalism that feels quite unique.

For an upcoming edition, I’d mainly hope for a bit more pleasing graphics for the main board, company boards, and assets. A blinged up version of Greed might actually be pretty amazing. The hobby has also changed since 2009 and it’s time to update the graphics to have a new—let’s call it “less male oriented”—view on things. Some minor tweak to make the last two rounds more exciting/relevant would also be welcome, or alternatively something that would cut down playtime by 30-60min. But otherwise, Greed Incorporated already is quite brilliant as is. Not to the level of an Indonesia or Antiquity brilliant, but still brilliant, in a wacky kind of way.